Big Bank Challenges: The Inside Scoop You Need To Know

So, you’ve probably heard about the big bank challenges that have been making headlines lately. It’s not just about money—it’s a whole new world of problems, opportunities, and game-changing decisions. Whether you’re an investor, a customer, or just someone curious about how these financial giants are navigating turbulent waters, this article’s got your back. Stick around, because we’re diving deep into the nitty-gritty of what’s really going on in the banking world.

Think about it: banks are like the backbone of our economy. They’re supposed to keep everything running smoothly, right? But lately, they’ve been facing some serious hurdles. From tech disruptions to regulatory pressures, the challenges are piling up faster than you can say "foreclosure." And guess what? These issues don’t just affect the bigwigs—they affect you too.

Now, before we dive into the juicy details, let’s set the stage. This article isn’t just a boring list of facts and figures. We’re breaking it down in a way that makes sense, even if finance isn’t your thing. By the end of this read, you’ll have a clearer picture of why big banks are struggling, what they’re doing about it, and how it impacts your wallet. Sound good? Let’s get started.

- Unveiling The Thrills Of Tn Atlanta A Deep Dive Into The Heart Of Southern Charm

- Discover The Charm Of Photos De Grand Buffet Chenocircve

Table of Contents

- What Are Big Bank Challenges?

- The Rise of Fintech: A Game-Changer

- Regulatory Pressures: The Legal Battle

- Cybersecurity Threats: Protecting Your Data

- Economic Uncertainty: The Bigger Picture

- Climate Change: The New Financial Frontier

- Customer Expectations: Meeting the Modern Consumer

- Talent Wars: Attracting the Best Minds

- Innovation vs Tradition: Striking a Balance

- The Future of Big Banks: Where Are We Headed?

What Are Big Bank Challenges?

Alright, let’s start with the basics. When we talk about big bank challenges, we’re referring to the obstacles that major financial institutions face in today’s rapidly changing world. These challenges come in all shapes and sizes, from technological disruptions to shifting customer demands. But what exactly are these challenges, and why should you care?

For one, big banks are under immense pressure to adapt to the digital age. Customers expect seamless online experiences, and if banks can’t deliver, they risk losing business to newer, more agile competitors. Add to that the ever-growing list of regulations, cybersecurity threats, and economic uncertainties, and you’ve got yourself a recipe for chaos. But don’t worry—we’ll break it down piece by piece.

The Evolution of Banking

Let’s rewind a bit. Back in the day, banking was simple. You walked into a branch, talked to a teller, and got your business done. Fast forward to today, and it’s a whole different ball game. The rise of digital banking has completely transformed the industry, forcing big banks to rethink their strategies. And let’s be real—some of them are struggling to keep up.

- Leg Curl The Ultimate Guide To Strengthening Your Hamstrings

- Baddie Huh The Ultimate Guide To Understanding The Culture Lifestyle And Impact

So, what does this mean for you? Well, it means that the banks you trust with your money are constantly evolving. They’re trying to balance tradition with innovation, and it’s not always easy. But hey, change is good, right?

The Rise of Fintech: A Game-Changer

Now, let’s talk about fintech. You’ve probably heard the term thrown around a lot, but what does it really mean? Simply put, fintech refers to financial technology—innovative solutions that are reshaping the way we handle money. Think mobile banking apps, peer-to-peer lending platforms, and digital wallets. These technologies are disrupting the traditional banking model, and big banks are feeling the heat.

Why? Because fintech companies are agile, customer-focused, and often cheaper than traditional banks. They’re able to offer services that are faster, more convenient, and more affordable. And guess what? Customers love it. In fact, a recent study found that 64% of consumers are using fintech services, and that number is only going up.

How Are Big Banks Responding?

So, how are big banks dealing with this fintech revolution? Well, some are embracing it, while others are struggling to catch up. Many banks are partnering with fintech companies to offer new services, while others are investing in their own digital platforms. It’s a race to stay relevant, and the stakes are high.

But here’s the thing: not all banks are created equal. Some are doing a great job of adapting, while others are lagging behind. And if they don’t step up their game, they risk losing customers to the competition. It’s a tough pill to swallow, but it’s the reality of the modern banking landscape.

Regulatory Pressures: The Legal Battle

Let’s shift gears and talk about regulation. You know, those pesky rules and laws that banks have to follow. Regulatory pressures are a big deal for big banks, and they’re only getting tougher. Governments around the world are cracking down on financial institutions, imposing stricter rules to protect consumers and maintain stability in the market.

Why is this happening? Well, after the 2008 financial crisis, regulators realized that banks needed more oversight. They couldn’t just let them do whatever they wanted without consequences. So, they started implementing new regulations to ensure that banks were operating responsibly. And while these rules are important, they’re also a major headache for banks.

The Cost of Compliance

Compliance with these regulations comes at a cost, and it’s not a small one. Banks have to invest heavily in systems and processes to ensure they’re meeting all the requirements. This can be a huge burden, especially for smaller banks that don’t have the same resources as the big guys. But even for the giants, it’s a challenge. They have to constantly monitor their operations to make sure they’re staying within the lines.

And let’s not forget about the fines. If a bank violates a regulation, they could be hit with some serious penalties. Just last year, several big banks were fined millions of dollars for various infractions. It’s a reminder that the regulatory landscape is no joke, and banks need to take it seriously.

Cybersecurity Threats: Protecting Your Data

Now, let’s talk about cybersecurity. In today’s digital world, data is king. And unfortunately, that makes banks a prime target for cybercriminals. Hackers are always looking for ways to exploit vulnerabilities in bank systems, and the consequences can be devastating. From stolen personal information to massive financial losses, the risks are real.

So, what are big banks doing to protect themselves? Well, they’re investing heavily in cybersecurity measures. This includes everything from firewalls and encryption to advanced threat detection systems. But here’s the catch: no system is foolproof. Even with the best security in place, there’s always a risk of a breach. And when that happens, it’s not just the bank that suffers—it’s the customers too.

Building Trust in a Digital Age

Trust is everything in banking, and cybersecurity plays a huge role in that. Customers need to feel confident that their data is safe, or they’ll take their business elsewhere. That’s why big banks are working hard to build trust through transparency and accountability. They’re being more open about their security measures and what they’re doing to protect customer data.

But it’s not just about technology. Banks are also focusing on education, helping customers understand how to protect themselves from cyber threats. It’s a collaborative effort, and it’s essential for maintaining trust in the digital age.

Economic Uncertainty: The Bigger Picture

Let’s zoom out for a moment and talk about the bigger picture. Economic uncertainty is another big challenge facing big banks. With global markets constantly in flux, it’s hard for banks to plan for the future. Factors like inflation, interest rates, and geopolitical tensions can all impact the banking industry in significant ways.

Take inflation, for example. When prices rise, it affects everything from loan rates to investment strategies. Banks have to adjust their operations accordingly, which can be a tricky balancing act. And then there’s the issue of interest rates. When rates go up, borrowing becomes more expensive, which can impact consumer spending and business growth. It’s a complex web of factors that banks have to navigate carefully.

Staying Ahead of the Curve

So, how are big banks staying ahead of the curve? Well, they’re relying on data and analytics to make informed decisions. By analyzing market trends and customer behavior, they can anticipate changes and adjust their strategies accordingly. It’s a proactive approach that’s essential in today’s uncertain economic environment.

But it’s not just about data. Banks are also focusing on diversification, spreading their risks across different sectors and markets. This helps them weather the storms when one area takes a hit. It’s all about resilience and adaptability in a rapidly changing world.

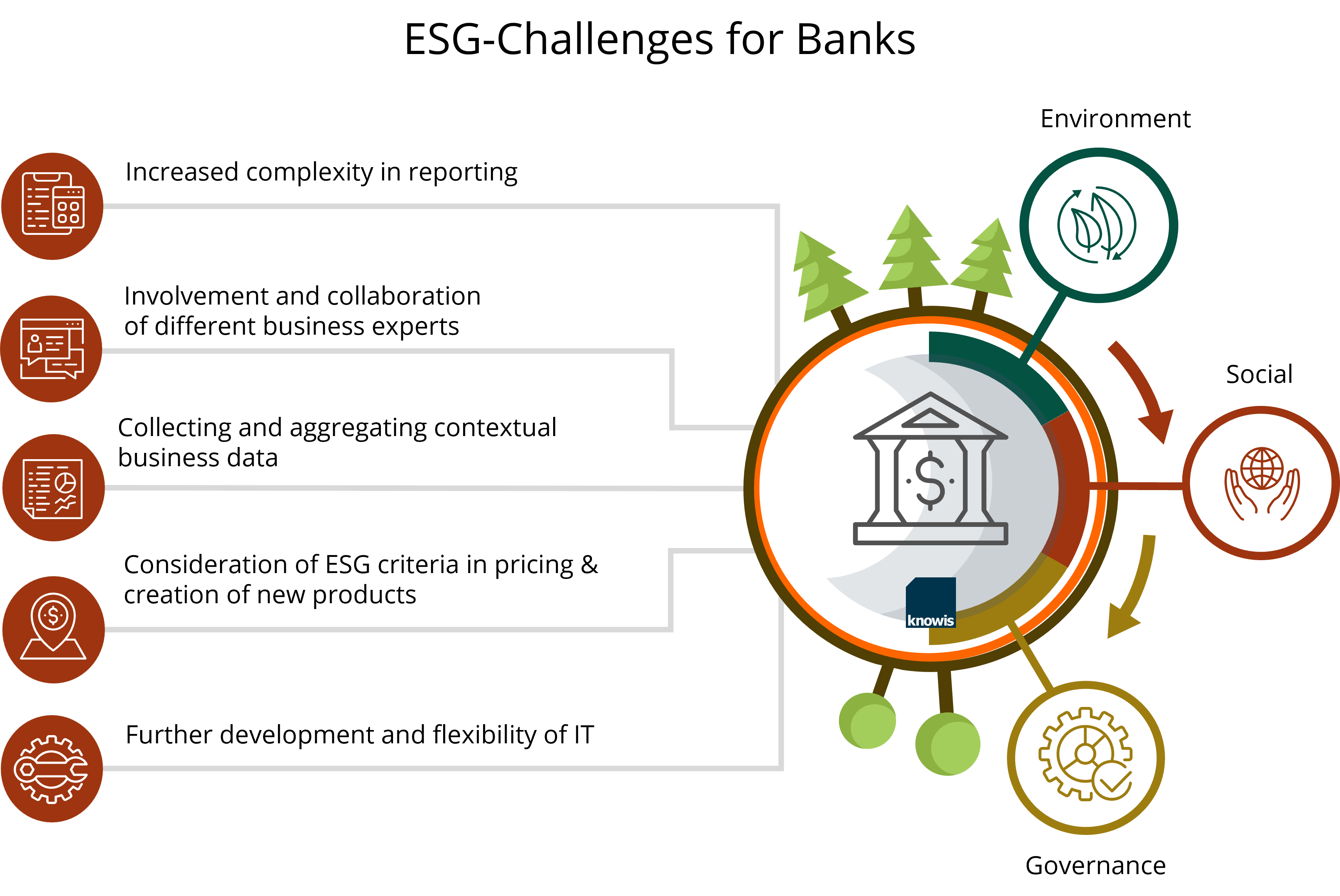

Climate Change: The New Financial Frontier

Now, let’s talk about something a little different: climate change. You might be wondering what this has to do with big banks, but trust me, it’s a big deal. Climate change is becoming a major financial issue, and banks are feeling the pressure to act. From investing in renewable energy to managing climate-related risks, the challenges are significant.

Why? Because climate change affects everything from real estate values to supply chains. If a bank has investments in areas that are vulnerable to natural disasters, they could face significant losses. And as consumers become more environmentally conscious, they’re expecting banks to do their part in addressing climate change.

The Green Banking Movement

So, what are big banks doing about it? Well, many are jumping on the green banking bandwagon. They’re investing in sustainable projects, offering eco-friendly financial products, and setting ambitious sustainability goals. It’s not just about doing the right thing—it’s about staying competitive in a market that values sustainability.

But here’s the catch: going green isn’t easy. It requires significant investments and changes in operations. And while some banks are leading the charge, others are lagging behind. It’s a race to the top, and the winners will be those who can adapt the fastest.

Customer Expectations: Meeting the Modern Consumer

Let’s shift our focus to the customer. In today’s digital age, customer expectations are higher than ever. People want fast, convenient, and personalized experiences, and if banks can’t deliver, they’ll go elsewhere. It’s a tough challenge, but one that big banks are taking seriously.

What do customers want? Well, they want easy access to their accounts, seamless mobile experiences, and personalized financial advice. They want banks to know them, understand their needs, and offer solutions that make their lives easier. And if a bank can’t do that, they risk losing business to competitors who can.

The Power of Personalization

So, how are big banks meeting these expectations? Well, they’re leveraging technology to offer more personalized experiences. From AI-powered chatbots to data-driven insights, banks are using technology to understand their customers better. They’re also investing in user-friendly interfaces and mobile apps that make banking easier and more convenient.

But it’s not just about technology. Banks are also focusing on customer service, ensuring that their employees are trained to provide exceptional experiences. It’s a holistic approach that’s essential for meeting the demands of the modern consumer.

Talent Wars: Attracting the Best Minds

Now, let’s talk about talent. In today’s competitive market, attracting and retaining top talent is a major challenge for big banks. They’re competing not just with other banks, but with tech companies, startups, and a whole range of industries for the best and brightest minds. And let’s be real—working at a bank isn’t always the most exciting prospect for young professionals.

So, how are big banks attracting talent? Well, they’re offering competitive salaries, flexible work arrangements, and opportunities for career growth. They’re also investing in training and development programs to help employees build the skills they need to succeed in a rapidly changing industry. It’s a battle for talent, and the banks that win will be the ones that can offer the best packages.

The Importance of Diversity

But it’s not just about attracting talent—it’s about diversity too. Banks are realizing that having a diverse workforce is essential for innovation and success. They’re working hard to create inclusive environments where everyone feels valued and respected. It’s not just the right thing to do—it’s good for business.

And let’s not forget about leadership. Banks are focusing on developing strong leaders who can guide their organizations through the challenges of the future. It’s a long-term strategy that’s

Detail Author:

- Name : Agustin Batz

- Username : serenity10

- Email : scorkery@gmail.com

- Birthdate : 1994-10-18

- Address : 8948 Betsy Orchard Isabellaside, AK 09440

- Phone : 1-859-887-6848

- Company : Lang-Ernser

- Job : Aircraft Cargo Handling Supervisor

- Bio : Excepturi rerum sapiente qui recusandae repellendus. Quia dolores incidunt voluptatibus impedit excepturi aut amet. Voluptas aliquid officia voluptates. Enim sed nihil non atque consequatur.

Socials

facebook:

- url : https://facebook.com/kaitlyn7737

- username : kaitlyn7737

- bio : Nihil nesciunt ut sed ad dolore quae neque.

- followers : 6739

- following : 2707

tiktok:

- url : https://tiktok.com/@kaitlyn6602

- username : kaitlyn6602

- bio : Ipsam nulla animi quia dolores. Ad officia repellat aut.

- followers : 340

- following : 1945

twitter:

- url : https://twitter.com/kaitlyn.hermann

- username : kaitlyn.hermann

- bio : Architecto et cumque quasi voluptatem. Officia quo et velit ducimus doloremque. Perspiciatis dignissimos omnis rerum illum ipsum ab quia.

- followers : 996

- following : 1522

linkedin:

- url : https://linkedin.com/in/hermann2005

- username : hermann2005

- bio : Earum deserunt eveniet deserunt.

- followers : 3902

- following : 1476

instagram:

- url : https://instagram.com/kaitlynhermann

- username : kaitlynhermann

- bio : Et quae enim voluptatum modi. Sunt non maxime quas. Id vel quas temporibus ducimus.

- followers : 2092

- following : 2956